Polite Appointment Reminders and Genuine Reviews: Automation Secrets

Every service business — from salons and spas to tattoo studios and clinics — faces two common challenges: missed appointments and inconsistent custom...

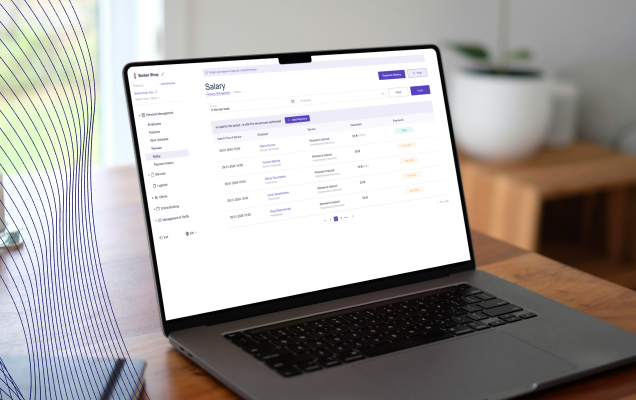

The payroll calculation service includes comprehensive solutions for automating and simplifying the process of calculating employee wages. This service allows employers to accurately and promptly make payments while complying with all tax and legal requirements. Typically, the service involves using specialized software that handles calculations, report generation, and automatic data updates in accordance with legislative changes.

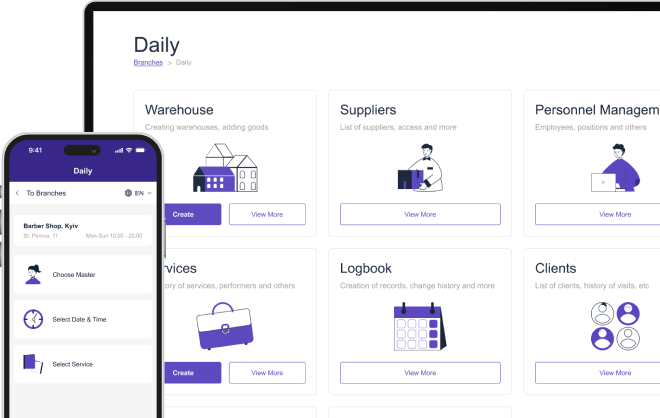

Effortless Booking Solutions with Me-Pos

Use for Free

Continuous data updates in line with legislative changes ensure regulatory compliance.

The system minimizes the risk of errors in calculating wages, taxes, and other deductions.

A high level of information protection ensures the security of employee data.

Automation significantly reduces the time spent on calculations and reporting.

Professional support and user training ensure quick adaptation to the system.

User-friendly software makes it easy to manage payments and reports.

A payroll calculation service addresses many issues faced by employers and accountants. Primarily, it eliminates the need for manual complex calculations, reducing the likelihood of errors and saving time. This is especially crucial for businesses with a large number of employees, where even small mistakes can have significant consequences. The service also helps avoid issues related to non-compliance with legal requirements, which can result in fines and other penalties. Additionally, automation allows employers to focus on other aspects of business management, enhancing overall operational efficiency.

Quick and easy installation and configuration of the payroll calculation system.

Easy import of employee data into the system for payroll calculation.

Complete automation of the payroll and deductions calculation process.

Automatic report generation and data updates in compliance with legal requirements.

Plans

Starter

Free /forever

Available by default upon registration

Lite

... /month

Disables the advertisement in the online booking

Premium

... /month

Ads-free and restrictions of branches and employees

Make sure that Me-Pos Online Booking meets your needs and requirements before making a final decision.

Features

Blog

Stay informed with our latest insights, updates, and tips on optimizing your business with Me-Pos. Discover valuable information to help you succeed.

Every service business — from salons and spas to tattoo studios and clinics — faces two common challenges: missed appointments and inconsistent custom...

For service-based venues — whether salons, spas, clinics, tattoo studios, or beauty centers — empty time slots mean lost revenue. Every unbooked chair...

Running a successful beauty salon isn’t just about offering great services or stylish interiors — it’s about building a high-performing team. Your sty...

In 2026, customer expectations are higher than ever. Clients want seamless communication, personalized experiences, fast service, and easy booking — a...

Running a small nail salon is often a balancing act between delivering beautiful results and managing a constant stream of appointments, walk-ins, and...

The tattoo industry has grown rapidly over the past decade — with creativity, artistry, and client experience becoming more important than ever. Yet m...

In today’s competitive beauty industry, convenience and accessibility are not just perks — they’re expectations. Traditional salons that relied on pho...

The hospitality industry is evolving rapidly, and the integration of technology plays a critical role in shaping guest experiences. One of the most tr...

Gathering customer reviews is essential for any business looking to build trust, improve services, and grow its online presence. However, how to ask c...

Starting a hotel business can be an exciting and rewarding venture, but it requires careful planning, significant investment, and a thorough understan...

In the competitive restaurant industry, the debate over service charges vs tips continues to shape customer experiences and employee compensation. As ...

The pet industry is booming, making it an ideal time for starting a pet store business. With pet ownership steadily increasing, the demand for quality...

Real estate is one of the most competitive industries out there. Whether you’re managing dozens of properties, closing sales with clients, or running ...

Designing the floor plan of a restaurant is one of the most crucial steps to building a thriving business. It’s more than just arranging tables—it’s a...

The age-old debate of wholesale vs. retail is more relevant than ever in today’s business world. Understanding the dynamics of these two models isn’t ...

Your beauty parlor is more than a place where clients come for a quick haircut or manicure. It’s a sanctuary, a haven where people go to feel refreshe...

Opening a liquor store can be an exciting and rewarding journey, but it’s not a business you want to jump into without preparation. From understanding...

In a bar, the barback is the hero working behind the scenes, keeping everything running smoothly. While bartenders are out there mixing drinks and cha...

Buying wholesale might sound like a game reserved for businesses, but let us tell you—it’s a goldmine for anyone smart enough to take advantage. Wheth...

Running a bar? Then you need a solid well drinks list to keep things moving. These well drinks are your bread and butter—affordable, quick to make, an...

So, you’re thinking about starting up a small business? That’s awesome! Whether you’re doing it for personal fulfillment, to escape the 9-to-5 grind, ...

So you want to start a food truck? Awesome choice! But before you hit the road, you have to figure out how much food trucks cost and what other expens...

Starting a pharmacy business can be a rewarding and profitable venture if approached correctly. Pharmacies play a crucial role in communities by provi...

Starting a gym business is a rewarding opportunity that combines a passion for fitness with entrepreneurial success. However, it involves far more tha...

Running a retail business is a balancing act. You have to manage products, customers, employees, and the store itself, all while trying to turn a prof...

The wellness industry is booming, offering excellent opportunities for entrepreneurs looking to start a spa business. In today's fast-paced world, mor...

Opening a new bar is an exciting venture, but it requires careful planning and attention to detail. Whether you dream of creating a laid-back pub or a...

Starting an ice cream truck business can be a lucrative and enjoyable venture for those who love being their own boss, engaging with the community, an...

Customer retention refers to a company’s ability to keep its customers over a sustained period, ensuring they continue to choose its products or servi...

As a business owner, managing income tax efficiently is crucial not only for maximizing profits but also for maintaining the long-term financial healt...

In the rapidly evolving landscape of supply chain and logistics, efficient warehouse management has become a cornerstone of business success. As compa...

Opening a restaurant is an exciting yet challenging endeavor that requires more than just a great concept and a mouth-watering menu. Among the first a...

Starting a hair salon can be an exciting and rewarding venture. This comprehensive guide aims to provide you with information on how to open a hairdre...

Choosing the best small business software accounting can be a daunting task, given the multitude of options available in the market. The right softwar...

Starting a nail salon business is an exciting venture that requires careful planning and preparation. The foundation of a successful nail salon lies i...

Opening a beauty salon is an exciting venture that requires careful planning, research, and a clear understanding of the costs involved. Proper planni...

Effective promotion strategies are crucial for the success of any restaurant. This comprehensive guide is designed to help restaurant owners and manag...

Designing a restaurant menu is a crucial aspect of the restaurant industry. A well-crafted menu does more than list the dishes offered; it serves as a...

In the bustling environment of a restaurant, safety, and comfort are paramount for the well-being of workers. Non-slip restaurant industry shoes are c...

This guide will walk you through the essential steps to choosing awesome names for restaurants, ensuring they resonate with your target audience and s...

This guide will walk you through the essential steps to open a bakery shop, from initial planning to the grand opening. Whether you’re a first-time en...

Opening a coffee bar can be a rewarding business venture, combining the love of coffee with the opportunity to create a community space. This comprehe...

Every service business — from salons and spas to tattoo studios and clinics — faces two common challenges: missed appointments and inconsistent custom...

For service-based venues — whether salons, spas, clinics, tattoo studios, or beauty centers — empty time slots mean lost revenue. Every unbooked chair...

Running a successful beauty salon isn’t just about offering great services or stylish interiors — it’s about building a high-performing team. Your sty...

In 2026, customer expectations are higher than ever. Clients want seamless communication, personalized experiences, fast service, and easy booking — a...

Running a small nail salon is often a balancing act between delivering beautiful results and managing a constant stream of appointments, walk-ins, and...

The tattoo industry has grown rapidly over the past decade — with creativity, artistry, and client experience becoming more important than ever. Yet m...

In today’s competitive beauty industry, convenience and accessibility are not just perks — they’re expectations. Traditional salons that relied on pho...

The hospitality industry is evolving rapidly, and the integration of technology plays a critical role in shaping guest experiences. One of the most tr...

Gathering customer reviews is essential for any business looking to build trust, improve services, and grow its online presence. However, how to ask c...

Starting a hotel business can be an exciting and rewarding venture, but it requires careful planning, significant investment, and a thorough understan...

In the competitive restaurant industry, the debate over service charges vs tips continues to shape customer experiences and employee compensation. As ...

The pet industry is booming, making it an ideal time for starting a pet store business. With pet ownership steadily increasing, the demand for quality...

Real estate is one of the most competitive industries out there. Whether you’re managing dozens of properties, closing sales with clients, or running ...

Designing the floor plan of a restaurant is one of the most crucial steps to building a thriving business. It’s more than just arranging tables—it’s a...

The age-old debate of wholesale vs. retail is more relevant than ever in today’s business world. Understanding the dynamics of these two models isn’t ...

Your beauty parlor is more than a place where clients come for a quick haircut or manicure. It’s a sanctuary, a haven where people go to feel refreshe...

Opening a liquor store can be an exciting and rewarding journey, but it’s not a business you want to jump into without preparation. From understanding...

In a bar, the barback is the hero working behind the scenes, keeping everything running smoothly. While bartenders are out there mixing drinks and cha...

Buying wholesale might sound like a game reserved for businesses, but let us tell you—it’s a goldmine for anyone smart enough to take advantage. Wheth...

Running a bar? Then you need a solid well drinks list to keep things moving. These well drinks are your bread and butter—affordable, quick to make, an...

So, you’re thinking about starting up a small business? That’s awesome! Whether you’re doing it for personal fulfillment, to escape the 9-to-5 grind, ...

So you want to start a food truck? Awesome choice! But before you hit the road, you have to figure out how much food trucks cost and what other expens...

Starting a pharmacy business can be a rewarding and profitable venture if approached correctly. Pharmacies play a crucial role in communities by provi...

Starting a gym business is a rewarding opportunity that combines a passion for fitness with entrepreneurial success. However, it involves far more tha...

Running a retail business is a balancing act. You have to manage products, customers, employees, and the store itself, all while trying to turn a prof...

The wellness industry is booming, offering excellent opportunities for entrepreneurs looking to start a spa business. In today's fast-paced world, mor...

Opening a new bar is an exciting venture, but it requires careful planning and attention to detail. Whether you dream of creating a laid-back pub or a...

Starting an ice cream truck business can be a lucrative and enjoyable venture for those who love being their own boss, engaging with the community, an...

Customer retention refers to a company’s ability to keep its customers over a sustained period, ensuring they continue to choose its products or servi...

As a business owner, managing income tax efficiently is crucial not only for maximizing profits but also for maintaining the long-term financial healt...

In the rapidly evolving landscape of supply chain and logistics, efficient warehouse management has become a cornerstone of business success. As compa...

Opening a restaurant is an exciting yet challenging endeavor that requires more than just a great concept and a mouth-watering menu. Among the first a...

Starting a hair salon can be an exciting and rewarding venture. This comprehensive guide aims to provide you with information on how to open a hairdre...

Choosing the best small business software accounting can be a daunting task, given the multitude of options available in the market. The right softwar...

Starting a nail salon business is an exciting venture that requires careful planning and preparation. The foundation of a successful nail salon lies i...

Opening a beauty salon is an exciting venture that requires careful planning, research, and a clear understanding of the costs involved. Proper planni...

Effective promotion strategies are crucial for the success of any restaurant. This comprehensive guide is designed to help restaurant owners and manag...

Designing a restaurant menu is a crucial aspect of the restaurant industry. A well-crafted menu does more than list the dishes offered; it serves as a...

In the bustling environment of a restaurant, safety, and comfort are paramount for the well-being of workers. Non-slip restaurant industry shoes are c...

This guide will walk you through the essential steps to choosing awesome names for restaurants, ensuring they resonate with your target audience and s...

This guide will walk you through the essential steps to open a bakery shop, from initial planning to the grand opening. Whether you’re a first-time en...

Opening a coffee bar can be a rewarding business venture, combining the love of coffee with the opportunity to create a community space. This comprehe...

FAQ

Payroll calculating software is a specialized tool designed to automate the process of calculating employee wages. It simplifies payroll management by automatically calculating taxes, deductions, and benefits while ensuring compliance with local laws.

A payroll calculation template provides a standardized format for entering employee data and calculating wages. It ensures consistency and accuracy in payroll calculations, saving time and reducing the likelihood of errors.

Yes, even if you use software, it’s a good practice to check your payroll calculations manually. This helps ensure that all data is correctly entered and that the software is calculating everything as expected, especially when dealing with complex payroll structures.

Payroll calculation services offer comprehensive solutions for managing payroll, ensuring compliance with tax regulations, and handling employee payments efficiently. These services typically include software for automating calculations, report generation, and staying updated with legal changes.

Contacts

Our contacts

Technical support service works 24/7. Send us an email if you have questions or need consultation.

Knowledge base

Useful articles and tips for a more detailed acquaintance with the Me-Pos service. Answers to frequently asked questions, etc.

ME-Pos and our partners uses cookies to keep site secure, ensure optimal performance, and provide you with personalized ads and experience. Our site will not work correctly without cookies and you will not be able to use it.