Maximizing Profit in Restaurants: Service Charge vs. Gratuity

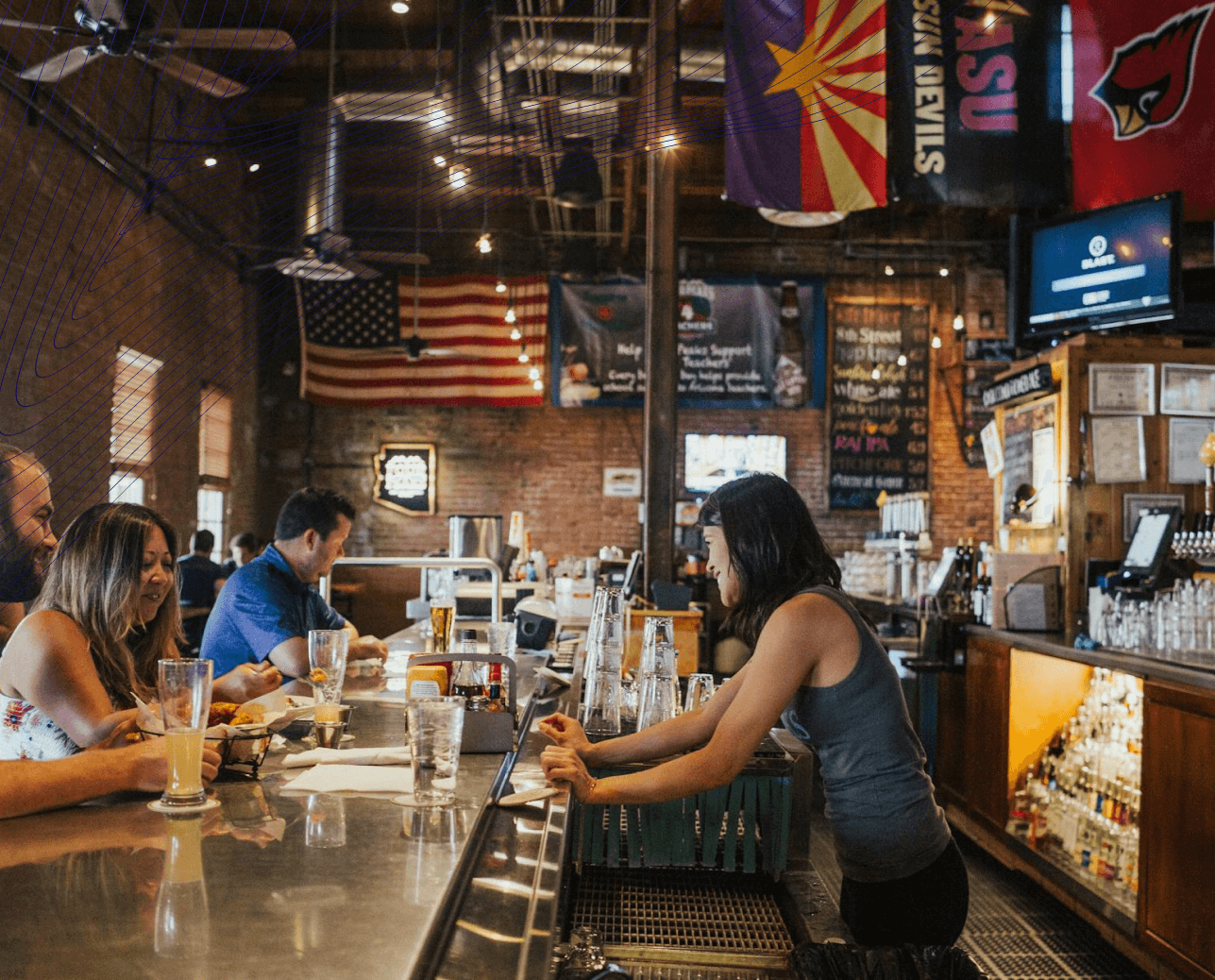

In the competitive restaurant industry, the debate over service charges vs tips continues to shape customer experiences and employee compensation. As businesses strive to find the right balance between profitability and fair wages, understanding the nuances between restaurant service charge and tips becomes essential. For restaurant owners and managers, properly implementing these revenue streams can significantly impact operational efficiency and staff satisfaction. In this article, we’ll explore the intricate relationship between tips and service charges, offering insights into how restaurants can effectively utilize both to maximize income and enhance employee morale.

The Fundamentals: What Are Service Charges and Tips?

Before diving into comparisons and strategies, it's crucial to define what is a service charge in a restaurant and what does tip mean. Though they both contribute to staff earnings, their function, legality, and perception differ substantially.

Defining Tips

Tips are voluntary contributions from customers to service staff, rewarding good service. These payments are typically left at the customer’s discretion and can range from small gestures of appreciation to generous sums that reflect exceptional service. While the general tipping standard falls between 15-20% of the bill, there is no universal rule, making the practice subjective and unpredictable. This system not only allows customers to reward service based on experience but also introduces variability in employee income, which can lead to disparities between high-performing staff and others.

In many restaurants, tipping is a crucial part of an employee’s earnings, with some servers relying heavily on gratuities to supplement their base wages. This practice, while beneficial for high-performing individuals, may create an environment where compensation becomes inconsistent and unpredictable, potentially affecting morale and retention.

Understanding Service Charges

A restaurant service charge is a mandatory fee added to a customer's bill, ensuring a standardized contribution to staff income regardless of service quality. Unlike tips, service charges eliminate the discretionary aspect of compensation, providing employees with a more predictable source of income. This approach simplifies the compensation structure by distributing earnings more equitably across the workforce.

While service charges can stabilize wages, their mandatory nature can sometimes lead to customer dissatisfaction, particularly if the quality of service does not meet expectations. However, for businesses, service charges offer a reliable way to cover labor costs, ensuring that all employees, from front-of-house to back-of-house staff, receive fair compensation.

Tip Out: Sharing the Wealth

The term "tip out" refers to the redistribution of tips among restaurant staff. This practice ensures that not only servers but also bartenders, hosts, and kitchen staff benefit from the tip pool. The process of tipping out fosters a sense of teamwork, encouraging employees to collaborate and contribute to overall service quality. However, implementing tip-out policies can be complex, as it requires careful consideration of how funds are distributed to maintain fairness and transparency.

A well-structured tip-out system can enhance workplace morale and reduce tension between front and back-of-house employees, promoting a more harmonious work environment. On the flip side, misunderstandings regarding tip distribution can lead to dissatisfaction, making it essential for management to clearly communicate policies and procedures.

Right Tip Amount: How Much Should You Tip at a Restaurant?

Diners frequently wonder how much should I tip at a restaurant or how much tip at a restaurant is appropriate. While tipping norms vary, the industry standard typically falls between 15-20% of the total bill. However, numerous factors influence tipping behavior, from personal preferences to cultural norms and regional practices.

For instance, customers dining at upscale establishments may feel inclined to leave higher tips, reflecting the elevated level of service and ambiance. Conversely, casual dining environments often see lower tip amounts, driven by different customer expectations and spending habits. Additionally, tipping customs differ significantly between countries, with some cultures embracing generous tipping practices while others prioritize all-inclusive pricing models.

Educating customers about appropriate tipping practices can enhance their dining experience, fostering positive relationships between patrons and staff. By providing suggested tip amounts on receipts or menus, restaurants can subtly guide customer behavior, ensuring that employees receive fair compensation without creating discomfort or pressure.

Service Charges vs. Gratuity: What’s the Difference?

Is service charge gratuity? This question often confuses diners and restaurant owners alike. Though they appear similar, service charges and gratuity have distinct legal implications and operational applications.

Service charges are pre-determined by the restaurant and cannot be adjusted by the customer, unlike gratuity, which is an extension of the tipping culture. This table clarifies the essential differences, enabling restaurant owners to implement the best model for their business.

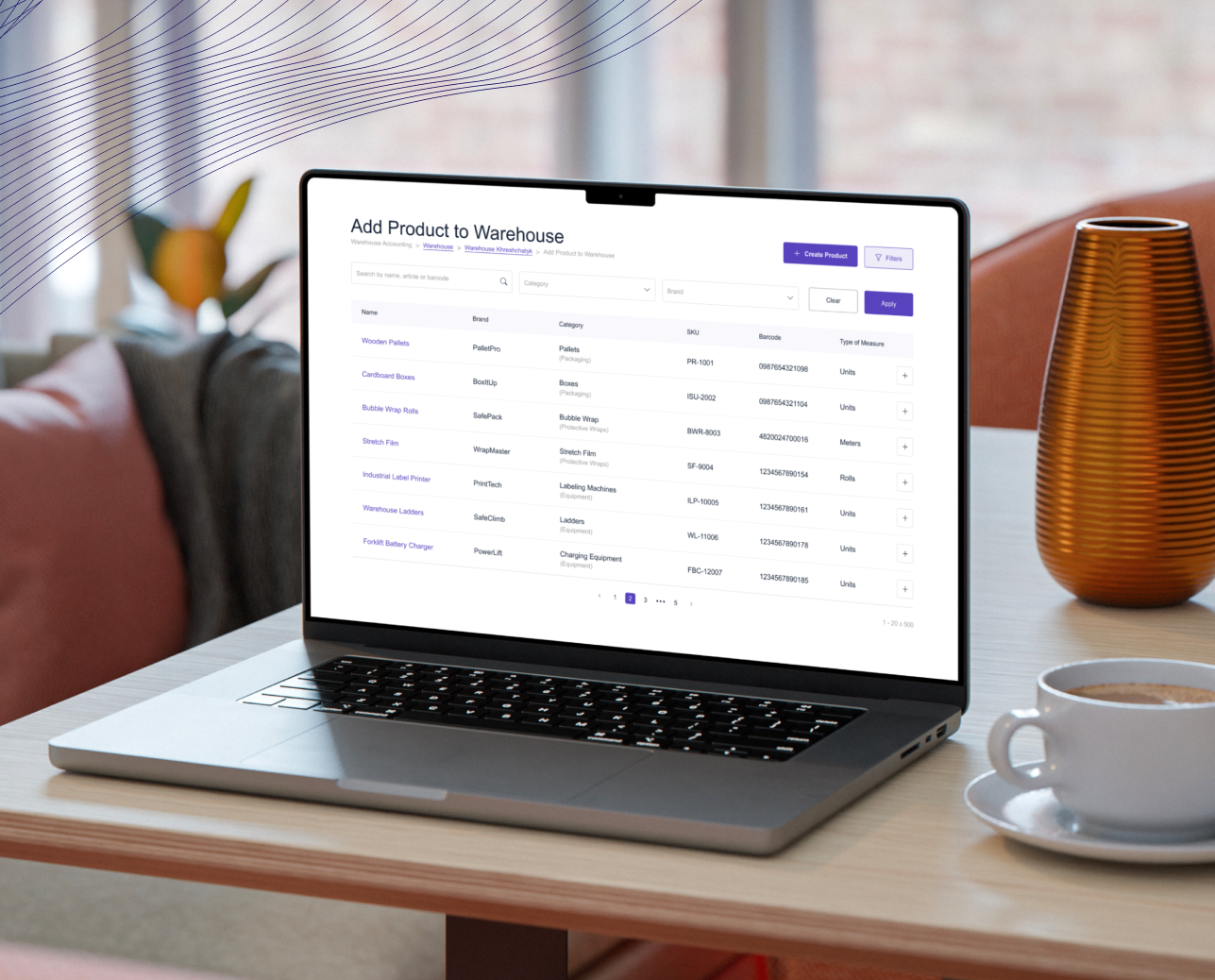

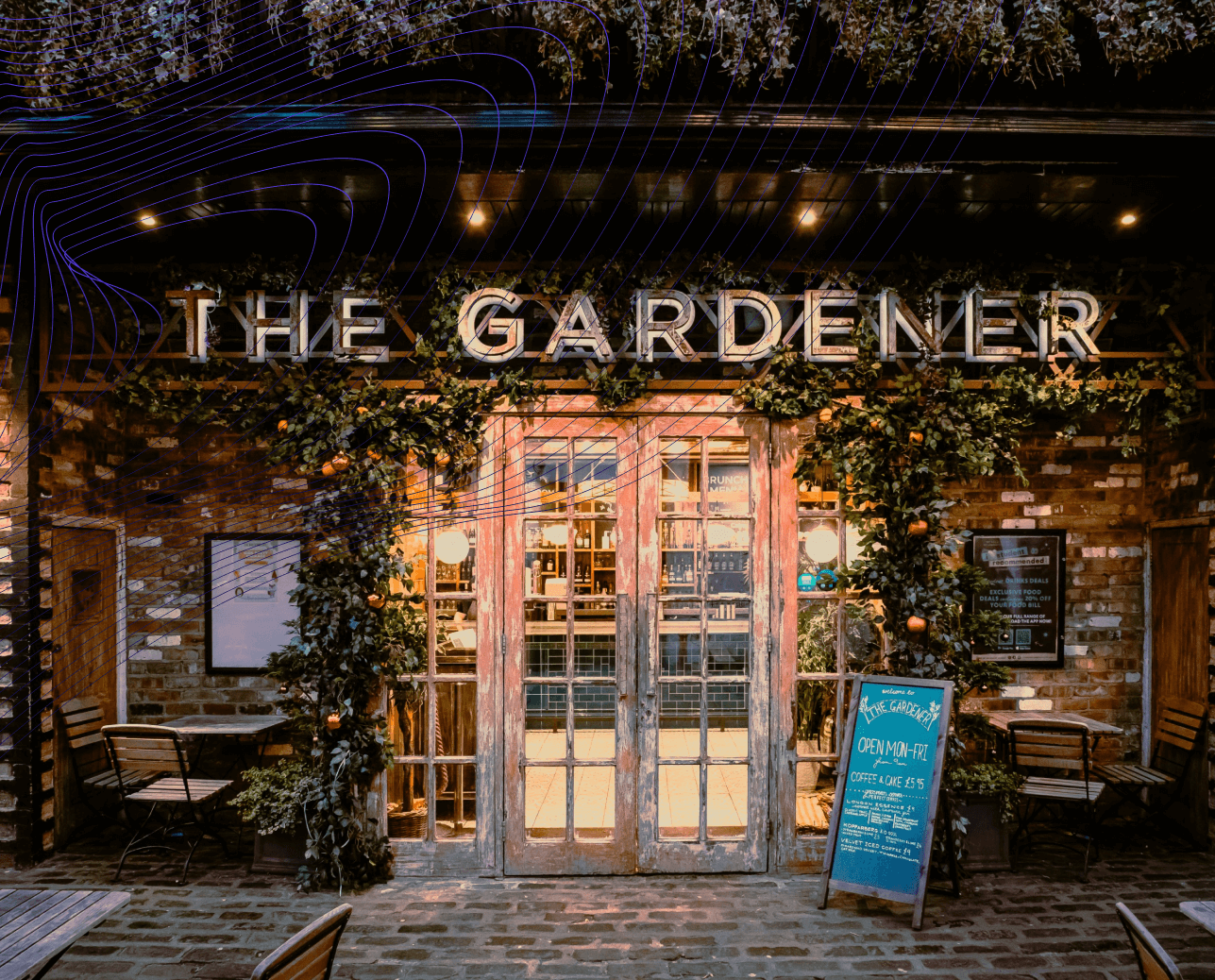

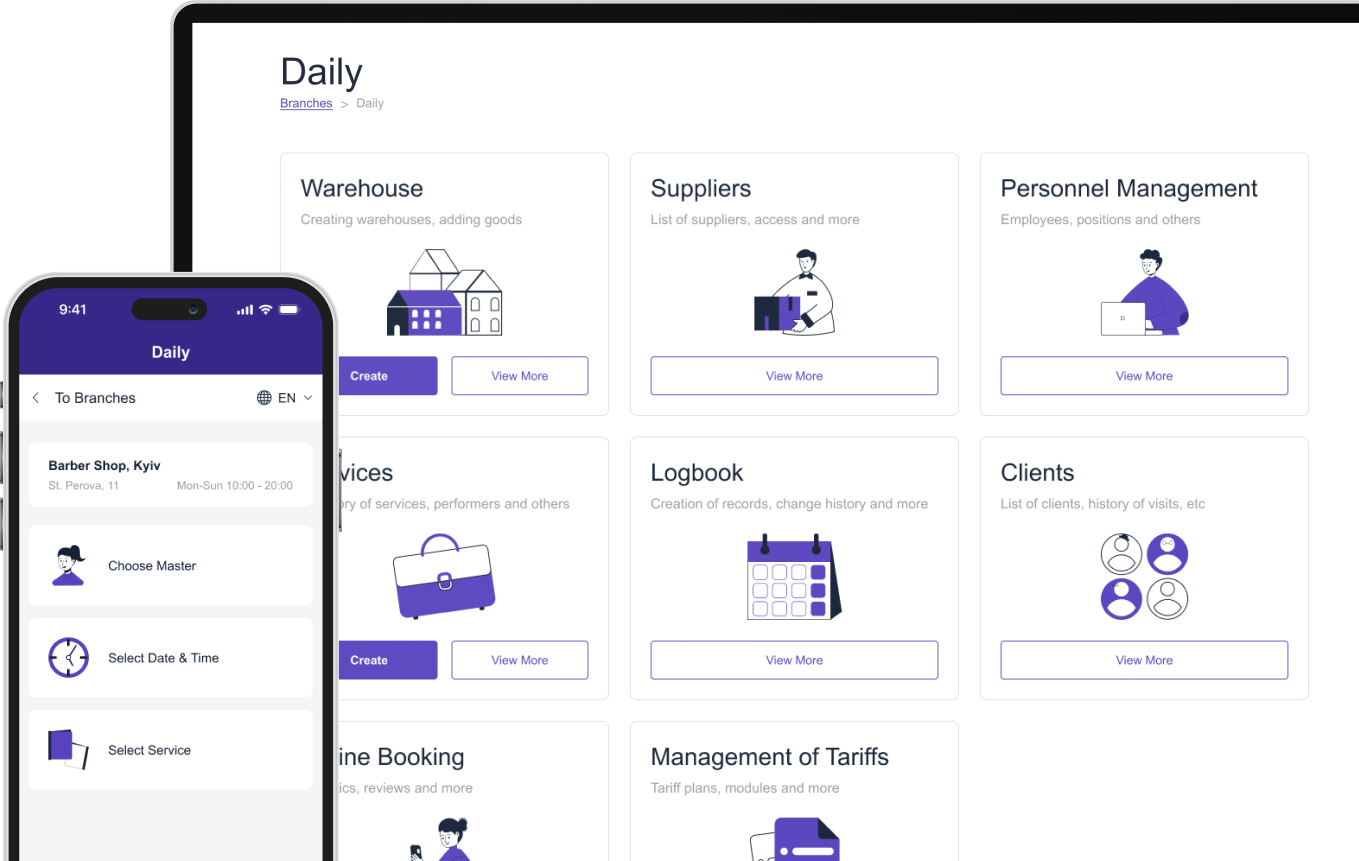

When implementing either system, restaurants must consider their target market, staff preferences, and operational needs. Modern POS systems like Me-POS can accommodate both approaches, allowing restaurants to track and manage either system effectively. The choice between service charges and gratuities often depends on the restaurant's business model, location, and customer base, with each option offering distinct advantages for different situations.

Make sure that Me-Pos Online Booking meets your needs and requirements before making a final decision.

The Role of Service Charges in Restaurant Operations

Understanding what is a service charge in a restaurant is crucial for modern food service operations. The definition of service charge encompasses mandatory fees added to customers' bills to cover various operational costs and ensure fair staff compensation. Unlike traditional tipping, restaurant service charge provides a more structured approach to revenue management and staff compensation.

Benefits of Service Charges

A well-implemented fee for service system offers several significant advantages for restaurant operations. Here are the key benefits that make service charges valuable:

- Predictable Revenue - Enables better financial planning and stability

- Consistent Staff Income - Reduces income volatility

- Simplified Accounting - Streamlines payroll and tax reporting

- Enhanced Team Collaboration - Minimizes internal competition

- Improved Customer Experience - Eliminates tipping calculations

These benefits contribute to a more stable and efficient operation, but implementing them requires careful planning and consideration of your specific restaurant's needs. The predictability of service charges allows restaurants to better manage their cash flow and make informed decisions about staffing, inventory, and expansion plans. Additionally, when staff members can rely on consistent income, they tend to focus more on providing excellent service rather than maximizing tips from individual tables.

How to Implement Service Charges

Implementing a charge for services system requires thorough preparation and strategic planning. Before diving into the implementation process, restaurants should assess their current operations, staff structure, and customer base to ensure a smooth transition.

1. Review Legal Requirements

- Research local and state regulations

- Consult with legal experts

- Update business documentation

- Prepare compliance statements

2. Configure Systems and Processes

- Set up POS system configurations (Me-POS provides specialized tools for this)

- Establish distribution formulas

- Create reporting templates

- Document all procedures

3. Prepare Communication Strategy

- Develop staff training materials

- Create customer notification materials

- Update menu designs

- Plan implementation timeline

Following these steps systematically helps ensure a successful transition to a service charge model while maintaining positive relationships with both staff and customers.

How to Manage Service Charges

Effective management of service charges is crucial for long-term success. Before implementing any management strategies, ensure you have the right tools and systems in place to handle the additional administrative requirements.

1. Monitor Financial Impact

- Track revenue changes

- Analyze staff earnings

- Review customer spending patterns

- Assess operational costs

2. Maintain Clear Communication

- Hold regular staff meetings

- Address customer feedback

- Update policies as needed

- Provide ongoing training

3. Utilize Technology Solutions

- Implement automated calculations

- Generate regular reports

- Track distribution accuracy

- Monitor system performance

These management practices help ensure the service charge system remains effective and beneficial for all stakeholders while maintaining operational efficiency and staff satisfaction.

Conclusion

Effective management of service charges and tipping systems requires careful planning and proper tools. Modern solutions like Me-POS systems provide comprehensive features for managing both service charges and tips efficiently. Understanding how much is the tip for restaurant services and implementing appropriate systems can significantly impact customer satisfaction and staff retention. Success lies in maintaining transparency, ensuring compliance, and utilizing appropriate technology solutions.

Was This Article Helpful?

Click on a star to rate it!

Thank you for your vote!

Average Rating: 5/5 Votes: 1

Be the first to rate this post!

View more

Related Articles

How to Reduce Income Tax for Business Owners?

As a business owner, managing income tax efficiently is crucial not only for maximizing profits but also for maintaining the long-term financial healt...

Master the Art of Buying Wholesale and Unlock Unbeatable Deals

Buying wholesale might sound like a game reserved for businesses, but let us tell you—it’s a goldmine for anyone smart enough to take advantage. Wheth...

Retail vs Wholesale: Key Differences and Which Is Right for You?

The age-old debate of wholesale vs. retail is more relevant than ever in today’s business world. Understanding the dynamics of these two models isn’t ...

How to Reduce Income Tax for Business Owners?

As a business owner, managing income tax efficiently is crucial not only for maximizing profits but also for maintaining the long-term financial healt...

Master the Art of Buying Wholesale and Unlock Unbeatable Deals

Buying wholesale might sound like a game reserved for businesses, but let us tell you—it’s a goldmine for anyone smart enough to take advantage. Wheth...

Retail vs Wholesale: Key Differences and Which Is Right for You?

The age-old debate of wholesale vs. retail is more relevant than ever in today’s business world. Understanding the dynamics of these two models isn’t ...

View more