20 Tips to Choose the Best Accounting Software for Small Businesses

Choosing the best small business software accounting can be a daunting task, given the multitude of options available in the market. The right software can streamline your financial processes, enhance accuracy, and save valuable time.

This article will guide you through the critical aspects of selecting the best small business software for accounting. We will discuss the importance of accounting software, key features to look for, and provide you with 20 essential tips to make an informed decision.

Do You Need Accounting Software for Your Small Business?

The best small business finance software plays a pivotal role in managing the financial health of small businesses. Here are several benefits of accounting software for small businesses:

Financial Management

The best small business online accounting software helps streamline financial processes, ensuring accuracy and efficiency in tasks such as invoicing, payroll, expense tracking, and financial reporting. This automation not only saves time but also reduces the likelihood of human error, which is crucial for maintaining accurate financial records.

Improved Accuracy

Manual bookkeeping is prone to errors, which can lead to significant issues down the line, such as incorrect tax filings or misrepresented financial health. Accounting software minimizes these errors by automating calculations and data entry, ensuring that your financial data is consistently accurate.

Time Savings

By automating repetitive tasks, the best small business accounting software frees up your time, allowing you to focus on other important aspects of your business. For instance, automated invoicing and payroll processing can save hours of manual work each month, providing you with more time to concentrate on growth strategies and customer service.

Real-Time Financial Insights

One of the significant advantages of accounting software is the ability to access real-time financial data and insights. This real-time access allows you to monitor your business's financial health continuously, make informed decisions promptly, and respond quickly to any financial issues that may arise.

Enhanced Compliance

Compliance with tax regulations and accounting standards is a critical aspect of running a business. Accounting software helps ensure that your financial records are maintained according to relevant regulations, reducing the risk of non-compliance and potential penalties. Many software options also offer features for generating tax reports and filings, further simplifying the compliance process.

Streamlined Reporting

Generating detailed financial reports is essential for understanding your business’s performance and planning for the future. Accounting software provides comprehensive reporting tools that allow you to create various reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports offer valuable insights into your financial status and help in strategic planning.

Key Features of the Best Accounting Software for a Small Business

When choosing the most popular small business accounting software, it is essential to look for features that meet your specific needs. Here are some key features to consider:

Invoicing

Efficient invoicing features help you manage billing and track payments with ease. Look for software that allows you to create and send invoices quickly, track unpaid invoices, and set up automatic payment reminders. Customizable invoice templates can also enhance your brand's professionalism, ensuring that your invoices reflect your business identity and are easy to understand for your clients.

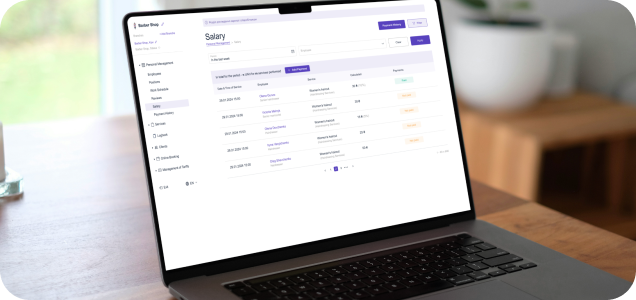

Payroll

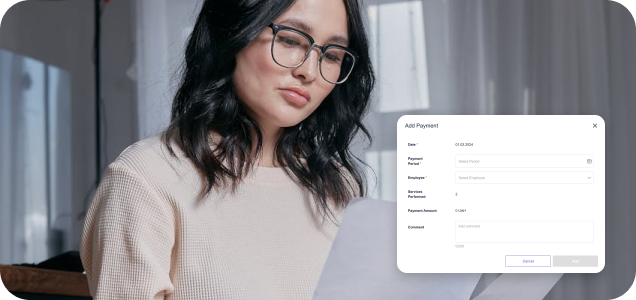

Integrated payroll functionalities simplify employee payment processes and tax calculations. The software should handle various payroll aspects, such as calculating wages, withholding taxes, and generating payroll reports. Some advanced options also offer direct deposit capabilities and employee self-service portals. This can greatly reduce the administrative burden and ensure that your employees are paid accurately and on time.

Expense Tracking

Automated expense tracking helps monitor and categorize business expenses accurately. Look for easy-to-use small business accounting software that allows you to capture receipts, categorize expenses, and integrate with your bank accounts for seamless transaction recording. This feature ensures that you always have a clear picture of your spending, which is crucial for budgeting and financial planning.

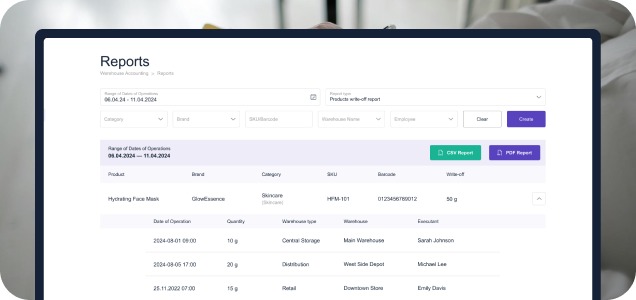

Financial Reporting

Comprehensive reporting tools provide detailed insights into your financial performance. The software should offer customizable reports and dashboards that allow you to analyze various aspects of your finances.

Key reports to look for include profit and loss statements, balance sheets, cash flow statements, and accounts receivable/payable aging reports. These reports can help you identify trends, make informed decisions, and communicate your financial status to stakeholders.

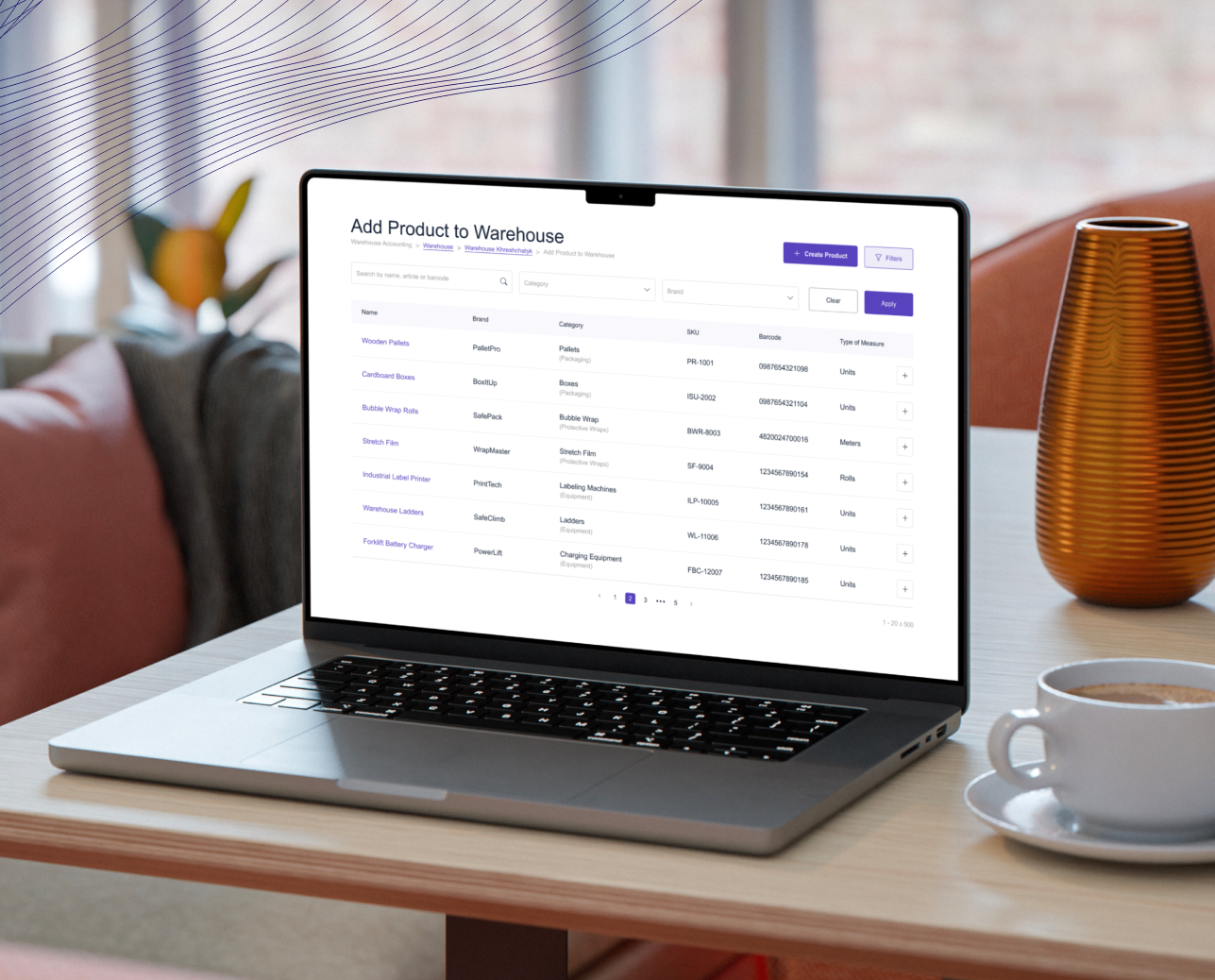

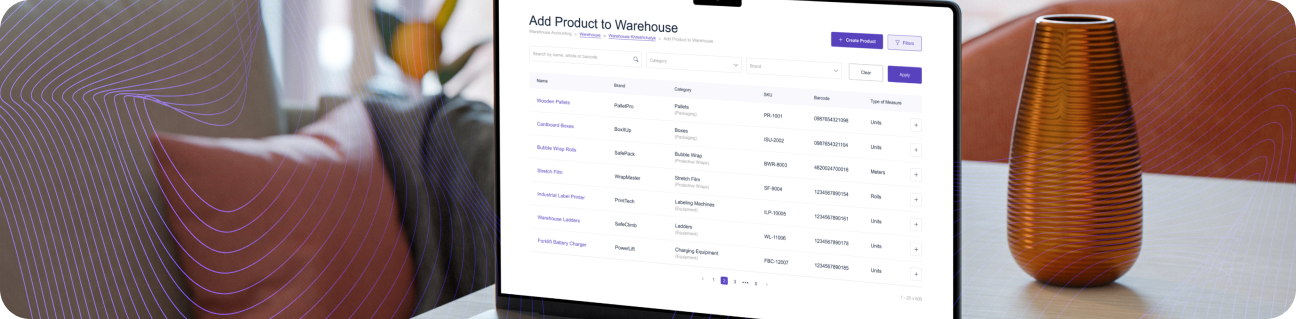

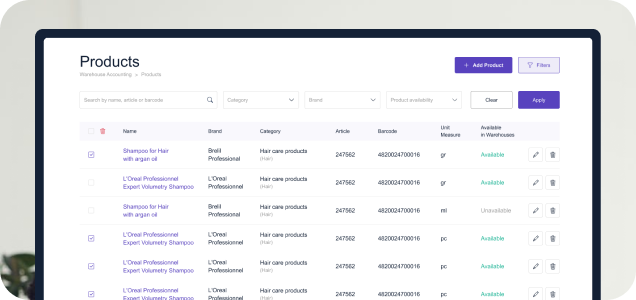

Inventory Management

If your business involves selling products, inventory management is a crucial feature. Good accounting software for small businesses with inventory management capabilities helps you track stock levels, manage orders, and monitor inventory costs.

This feature ensures that you always have the right amount of stock and can avoid issues such as stockouts or overstocking. Proper inventory management can also help you reduce costs and improve customer satisfaction by ensuring that products are available when needed.

Bank Reconciliation

Bank reconciliation features help you match your bank statements with your accounting records, ensuring that all transactions are accounted for and discrepancies are identified promptly.

This process is essential for maintaining accurate financial records and detecting potential fraud. Regular bank reconciliations can also help you manage your cash flow more effectively and avoid overdraft fees or other banking issues.

Multi-Currency Support

For businesses that deal with international clients or suppliers, multi-currency support is vital. This feature allows you to handle transactions in different currencies, manage exchange rates, and generate reports that reflect the financial impact of currency fluctuations. Multi-currency support can help you expand your business globally and simplify the process of managing international finances.

Tax Management

Tax management features assist in calculating and filing taxes accurately. The software should support various tax forms and schedules relevant to your business and jurisdiction.

Automated tax calculations and report generation can significantly reduce the time and effort required for tax compliance, ensuring that you meet your tax obligations on time and avoid penalties.

How to Choose Accounting Software for Small Business?

Selecting the best accounting software involves several steps and considerations. Here’s a detailed guide on how to choose the best accounting software:

Evaluate Your Needs

Start by understanding your business's specific accounting requirements. Consider the size of your business, the complexity of your financial transactions, and any industry-specific needs.

For example, a retail business may require robust inventory management features, while a service-based business might prioritize time tracking and billing capabilities. Make a list of the essential features you need and any additional features that would be nice to have.

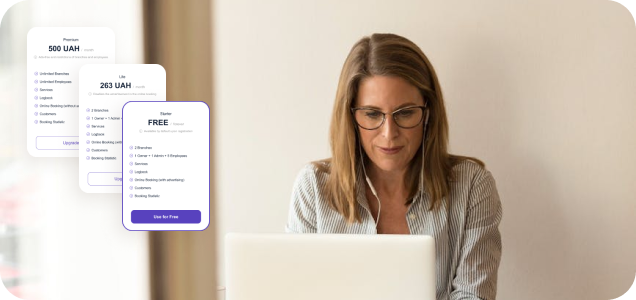

Set a Budget

Determine how much you are willing to spend on accounting software. Prices can vary widely, from free options with basic features to premium solutions with extensive capabilities. It's essential to balance cost with the features and functionality you need, ensuring that you get the best value for your money.

Remember to consider the total cost of ownership, including any ongoing subscription fees, upgrade costs, and potential costs for additional users or features.

Compare Options

Incorporate small business accounting software comparison. Research different software options, their features, pricing, and user reviews. Look for software that has a strong reputation in the market and meets your business's specific needs.

Make a list of potential options and evaluate them based on criteria such as functionality, ease of use, customer support, and scalability. Pay attention to any limitations or issues mentioned in user reviews, as these can provide valuable insights into the software's performance and reliability.

Test the Software

Utilize free trials and demos to test the software’s features and usability. Hands-on experience with the software allows you to assess whether it meets your requirements and is easy to use.

Pay attention to the user interface, navigation, and the availability of help resources during the trial period. Testing the software in real-world scenarios can help you identify any potential issues and ensure that it integrates smoothly with your existing systems.

Seek Recommendations

Ask for recommended small business accounting software from other business owners or professionals in your industry. Personal referrals can provide valuable insights into the software's performance and reliability.

Additionally, consider consulting with your accountant or financial advisor for their input on the best accounting software for your business. They may have experience with different software options and can provide guidance based on their expertise.

20 Tips on How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software can significantly impact your business's efficiency and accuracy in managing finances. Below are 20 essential tips to help you make an informed decision:

1. Determine Your Business Needs

Assess your specific accounting requirements to ensure the software meets all your business needs. Consider factors such as the size of your business, industry-specific requirements, and the complexity of your financial transactions. A thorough needs assessment helps narrow down the options and ensures that you choose software that aligns with your operational requirements.

For instance, a business that frequently handles inventory may require software with robust inventory management features, while a service-based business might prioritize time tracking and billing functionalities.

2. Consider User-Friendliness

Choose software with an intuitive and easy-to-use interface, especially if you or your staff do not have extensive accounting expertise. User-friendly software reduces the learning curve and helps ensure that you can quickly get up to speed with the software's features.

Look for very simple small business accounting software with a clean design, straightforward navigation, and accessible help resources. User-friendly software enhances productivity and minimizes frustration, allowing you to focus on managing your business rather than struggling with complex tools.

3. Assess Integration Capabilities

The software should integrate seamlessly with other tools and systems you use, such as your CRM, e-commerce platform, or payment processors. Integration facilitates smooth data flow and reduces the need for manual data entry.

Check if the software offers integration options with third-party applications and whether it supports popular accounting and business tools. Integration capabilities enhance efficiency by ensuring that all your systems work together cohesively, reducing duplication of effort and minimizing errors.

4. Evaluate Cost and Pricing Plans

Compare different pricing plans and understand what features and services are included at each price level. Consider both the initial cost and any ongoing subscription fees or additional costs for extra features. Ensure that the pricing aligns with your budget and offers good value for the features provided.

Look for transparent pricing structures and be wary of hidden fees or charges. Evaluating cost and pricing plans helps you choose software that fits your budget while meeting your business needs.

5. Check for Scalability

Choose software that can grow with your business and handle increased volume and complexity over time. Scalability is essential to avoid having to switch to a new system as your business expands.

Look for software that offers flexible plans or add-ons that accommodate future needs. Scalable software ensures that you can continue using the same system as your business evolves, reducing the need for costly and disruptive transitions.

6. Look for Cloud-Based Solutions

Consider the benefits of cloud-based accounting software, such as accessibility from any device, automatic updates, and enhanced security. Cloud solutions also offer scalability and often lower upfront costs. Ensure that the cloud provider has robust security measures in place, such as data encryption and regular backups.

Cloud-based software can also facilitate remote work and collaboration, which is increasingly important in today's business environment. Evaluate the software's cloud infrastructure and ensure it meets your security and accessibility needs.

7. Review Customer Support Options

Ensure robust customer support, including various contact methods such as phone, email, and live chat. Reliable support is crucial for resolving issues quickly and minimizing downtime. Check the availability of support services, such as 24/7 support, dedicated account managers, and access to a comprehensive knowledge base.

Good customer support can make a significant difference in your overall experience with the best accounting software for a new small business. Evaluate the responsiveness and effectiveness of the support team to ensure that you receive timely assistance when needed.

8. Explore Mobile Accessibility

Mobile access to your accounting software allows you to manage finances on the go, offering flexibility and convenience. Look for software with a dedicated mobile app or a responsive web interface. Mobile access is particularly useful for business owners who travel frequently or need to manage operations outside the office.

Ensure that the mobile version offers a user-friendly interface and all the essential features of the desktop version. Mobile accessibility enhances productivity by enabling you to perform critical tasks from anywhere.

9. Investigate Security Features

Critical security features to look for include data encryption, multi-factor authentication, and regular security updates. Protecting your sensitive financial data should be a top priority. Verify that the software complies with relevant data protection regulations and industry standards, such as GDPR or SOC 2.

Robust security measures will help safeguard your business against data breaches and cyberattacks. Evaluate the software’s security protocols to ensure that your financial data is well-protected.

10. Read Reviews and Testimonials

Reading reviews and testimonials from other users provides insights into the software’s reliability and user satisfaction. Look for patterns in feedback regarding ease of use, customer support, and functionality. Consider both positive and negative reviews to get a balanced perspective on the software’s performance.

User reviews can reveal potential issues that you might not have considered otherwise. Pay attention to feedback from users with similar business needs to gauge how well the software meets those requirements.

11. Take Advantage of Free Trials and Demos

Utilizing free trials and demos allows you to test the software’s features and usability before committing. This hands-on experience helps you make an informed decision. During the trial period, evaluate how well the software meets your needs and whether it integrates smoothly with your existing systems.

Pay attention to any issues that arise during the trial and how easy they are to resolve. Free trials and demos provide an opportunity to explore the software’s capabilities and ensure it aligns with your business requirements.

12. Verify Compliance with Regulations

Ensure the software complies with relevant accounting standards and tax regulations applicable to your business. Compliance is essential to avoid legal issues and ensure accurate financial reporting. Check if the software supports tax forms and schedules relevant to your jurisdiction and provides features for generating compliance reports.

Compliance features can help you stay on top of regulatory changes and avoid costly penalties. Verify that the software meets the necessary regulatory requirements for your industry and location.

13. Assess Reporting and Analytics Features

Detailed reporting and analytics features are crucial for gaining insights into your business’s financial health. Look for customizable reports and dashboards that provide real-time data. Advanced analytics tools can help you identify trends, monitor key performance indicators (KPIs), and make data-driven decisions.

Effective reporting capabilities will enable you to analyze your financial performance and plan for the future. Evaluate the software’s ability to generate comprehensive reports and provide actionable insights.

14. Consider Customization Options

Choose software that allows customization to fit the unique needs and processes of your business. Customizable software can adapt to your workflows and enhance efficiency. Look for options to customize reports, dashboards, and user roles to match your specific requirements.

Customization can help you tailor the software to your business operations and improve overall productivity. Ensure that the software offers sufficient flexibility to accommodate your business’s unique needs.

15. Examine Backup and Data Recovery Options

Reliable backup and data recovery features prevent data loss due to system failures or cyberattacks. Ensure the software offers automatic backups and easy data restoration. Regular backups and robust recovery options are essential for protecting your financial data and ensuring business continuity.

Backup features will provide peace of mind knowing that your data is safe and can be restored quickly if needed. Evaluate the software’s backup and recovery processes to ensure they meet your data protection needs.

16. Evaluate Training and Resources

Availability of training resources like tutorials, webinars, and documentation is important for effective software use. Comprehensive resources help users understand and utilize all features. Look for software providers that offer ongoing training opportunities and user communities for additional support.

Effective training can help you and your team get the most out of the software and improve overall efficiency. Consider the availability of resources to assist with onboarding and ongoing use.

17. Check for Multi-User Access

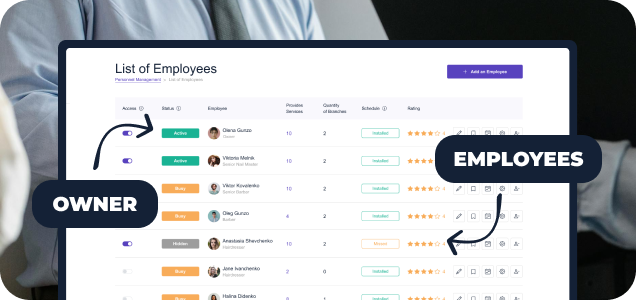

Select software that supports multiple users with appropriate permission levels for collaborative work. Multi-user access enables team members to work simultaneously without compromising data security. Ensure that the software allows you to set different access levels and permissions based on user roles.

Multi-user functionality can facilitate teamwork and ensure that everyone has access to the information they need. Evaluate how the software manages user permissions and supports collaborative workflows.

18. Investigate Automation Features

Automation features for routine tasks like billing, invoicing, and expense tracking save time and reduce errors. Look for software that offers extensive automation capabilities, such as automatic payment reminders, recurring invoices, and expense categorization. Automation improves efficiency and ensures that critical tasks are not overlooked.

By automating repetitive tasks, you can focus more on strategic activities and business growth. Assess the software’s automation features to determine how they can benefit your business operations.

19. Consider Vendor Reputation

Research the vendor’s reputation, history, and stability in the market. A reputable vendor ensures reliable support and continuous software improvement. Look for vendors with a track record of innovation, strong customer reviews, and a commitment to data security and customer service.

A well-established vendor is more likely to provide ongoing support and updates, ensuring that your software remains relevant and effective. Consider the vendor’s industry standing and history when making your decision.

20. Ensure Compatibility with Your Accountant’s Software

Choosing software that is compatible with the software used by your accountant facilitates seamless collaboration and data exchange. Compatibility simplifies the sharing of financial data and reports, reducing the need for manual data entry and minimizing errors. Discuss your options with your accountant to ensure smooth integration.

Compatibility with your accountant’s tools will streamline communication and ensure that your financial records are accurate and up-to-date. Verify that the software supports data formats and integrations used by your accountant.

Conclusion

You can not make the right choice without knowing the factors to consider when choosing accounting software, including your specific needs, budget, and desired features. By following the tips outlined in this article, you can make an informed decision and choose software that enhances your financial management.

Here is a summary of the 20 tips:

-

Determine Your Business Needs

-

Consider User-Friendliness

-

Assess Integration Capabilities

-

Evaluate Cost and Pricing Plans

-

Check for Scalability

-

Look for Cloud-Based Solutions

-

Review Customer Support Options

-

Explore Mobile Accessibility

-

Investigate Security Features

-

Read Reviews and Testimonials

-

Take Advantage of Free Trials and Demos

-

Verify Compliance with Regulations

-

Assess Reporting and Analytics Features

-

Consider Customization Options

-

Examine Backup and Data Recovery Options

-

Evaluate Training and Resources

-

Check for Multi-User Access

-

Investigate Automation Features

-

Consider Vendor Reputation

-

Ensure Compatibility with Your Accountant’s Software

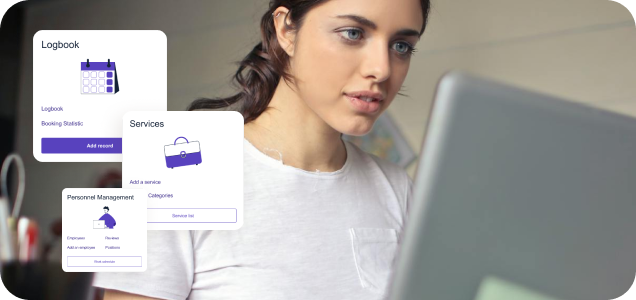

If you ask, «What is a good small business accounting software?» – among the various options available, ME-POS financial accounting stands out as a comprehensive solution for small businesses. With its robust features, user-friendly interface, and excellent customer support, ME-POS is designed to meet the diverse needs of small businesses.

View more

Related Articles

View more