How to Reduce Income Tax for Business Owners?

As a business owner, managing income tax efficiently is crucial not only for maximizing profits but also for maintaining the long-term financial health of your business. With the complexity of tax regulations, it's easy to overlook opportunities that could significantly reduce your tax burden.

By understanding the basics of business income tax, leveraging common deductions, and employing advanced strategies, you can effectively minimize the amount of tax you owe. This comprehensive guide will walk you through essential ways of reducing taxable income, from straightforward deductions to more sophisticated financial tactics.

Understanding the Basics of Business Income Tax

Before diving into specific strategies to reduce your income tax, it's essential to grasp the fundamentals of how business income tax works. The structure of your business – whether it's a sole proprietorship, partnership, corporation, or limited liability company (LLC) – plays a significant role in determining your tax obligations.

What is Business Income Tax?

Business income tax is a levy on the profits earned by a business. The way this tax is calculated and the rate at which it is applied can vary depending on your business's legal structure and the jurisdiction in which you operate. Generally, businesses are required to report their income and expenses annually, paying taxes on the net profit – what remains after all allowable expenses are deducted.

Understanding how income is taxed at different levels and by different entities is crucial for effective tax planning. By having a clear picture of how your income is taxed, you can identify areas where adjustments can be made to minimize tax liabilities.

Types of Business Entities and Their Tax Implications

Different business structures come with distinct tax obligations and advantages. It’s important to choose a structure that not only suits your business model but also offers the most favorable tax treatment.

-

Sole Proprietorship: As the simplest structure, a sole proprietorship involves the business owner reporting income and expenses on their personal tax return. The profit is taxed at the owner's personal income tax rate, making it straightforward but potentially costly if the business is highly profitable.

-

Partnership: In a partnership, income and expenses are shared among partners, each of whom reports their share on their personal tax return. This structure allows for flexibility in profit-sharing but requires careful planning to ensure equitable tax treatment among partners.

-

Corporation: A corporation is a separate legal entity that pays its own taxes. The type of corporation (C-corporation or S-corporation) significantly affects tax treatment. C-corporations are taxed at the corporate level and potentially again at the shareholder level, leading to double taxation. In contrast, S-corporations pass income directly to shareholders to be taxed at personal rates, avoiding double taxation but with stricter eligibility requirements.

-

Limited Liability Company (LLC): An LLC offers flexibility in tax treatment, allowing owners to choose whether the business is taxed as a sole proprietorship, partnership, or corporation. This flexibility can be advantageous, especially for businesses that expect changes in their financial or ownership structure over time.

Choosing the right structure can have lasting implications for your tax burden. Reviewing your business structure with a tax professional is advisable, especially as your business grows and evolves.

Common Tax Deductions for Business Owners

One of the most effective ways to reduce income tax is by taking advantage of deductions. The IRS allows businesses to deduct specific expenses considered ordinary and necessary for conducting business. These deductions directly lower your taxable income, thereby reducing the amount of tax you owe.

Office and Operating Expenses

Office and operating expenses are among the most common deductions available to business owners. These costs are essential for the daily operation of your business and can significantly reduce your taxable income. Let’s break down these expenses:

-

Rent: If you lease office space, the rent you pay is fully deductible. This deduction applies to all types of business premises, whether you operate from a traditional office, a retail space, or even a dedicated area of your home.

-

Utilities: Essential services such as electricity, water, heating, and internet are deductible. These costs are necessary for running your business and can add up, so keeping detailed records is important.

-

Supplies: Office supplies, including paper, pens, computers, and software, can be deducted as long as they are necessary for business operations. Even small expenses can add up over the year, making this a valuable deduction category.

Regularly documenting these expenses can help ensure you’re maximizing your deductions. Additionally, using accounting software to track these costs can make the process more manageable and accurate.

Employee Salaries and Benefits

Another major category of deductions for business owners is employee salaries and benefits. Offering competitive compensation and benefits can be a significant expense, but it also provides substantial tax advantages. Here’s how:

-

Wages: The total wages paid to your employees, including bonuses, commissions, and overtime, are fully deductible. This deduction is a straightforward way to reduce your taxable income, especially if you have a large or highly compensated workforce.

-

Payroll Taxes: The employer’s share of Social Security and Medicare taxes, along with state unemployment taxes, are deductible. These taxes are mandatory, so taking advantage of the deduction is crucial.

-

Employee Benefits: Costs associated with providing health insurance, retirement plans, and other benefits are also deductible. Offering benefits not only helps reduce your tax burden but also aids in attracting and retaining top talent, which is essential for business growth.

Effectively managing these deductions requires accurate record-keeping and a thorough understanding of which expenses qualify. By doing so, you can ensure that you're not leaving valuable deductions on the table.

Depreciation of Business Assets

Depreciation allows you to deduct the cost of significant business assets, such as machinery, vehicles, and equipment, over time. Instead of deducting the entire cost in the year of purchase, depreciation spreads the deduction across the useful life of the asset, which aligns with how assets lose value over time. Here are two key methods of depreciation:

-

Section 179 Deduction: This provision allows businesses to deduct the full purchase price of qualifying equipment and software purchased during the tax year, up to a specific limit. This can be particularly beneficial for businesses that need to invest in new equipment to remain competitive.

-

Bonus Depreciation: This allows businesses to take a larger deduction in the first year an asset is placed in service, accelerating the depreciation process. Bonus depreciation is especially useful when you’ve made substantial investments in assets and want to reduce your tax liability quickly.

Understanding and applying these ways to reduce taxable income can significantly save money, freeing up cash flow for other business needs.

Advanced Strategies on How to Reduce Taxable Income

Beyond the standard deductions, more advanced tax strategies can help business owners minimize their tax burden. These strategies often require careful planning and, in some cases, professional advice to implement effectively.

Retirement Plan Contributions

Contributing to a retirement plan is an excellent tax-saving method while securing your financial future. There are several retirement plan options available to business owners, each with its own set of benefits:

-

401(k) Plans: Business owners can establish a 401(k) plan for themselves and their employees. Contributions made to the plan are tax-deductible, and the earnings grow tax-deferred until withdrawn. This dual benefit makes 401(k) plans an attractive option for reducing taxable income and planning for retirement.

-

SEP-IRA: Simplified Employee Pension (SEP) IRAs are ideal for small businesses and self-employed individuals. Contributions are tax-deductible, and the limits are higher than those for traditional IRAs, offering significant tax savings.

-

Solo 401(k): Designed for self-employed individuals with no employees, this plan allows for substantial contributions that can reduce taxable income significantly. Solo 401(k) plans offer flexibility and high contribution limits, making them an excellent choice for high-income earners.

Choosing the right retirement plan requires careful consideration of your business’s financial situation and long-term goals. Consulting with a financial advisor can help you navigate the options and maximize the tax benefits.

Choosing the Right Business Structure

As mentioned earlier, the structure of your business has significant tax implications. Choosing the right structure can lead to substantial tax savings. Here’s a closer look at some options:

-

S-Corporation Election: If you operate as an LLC or a corporation, you might benefit from electing S-corporation status. This can help you avoid double taxation and potentially reduce self-employment taxes. S-corporation status allows income to pass directly to shareholders without being taxed at the corporate level, which can result in lower overall taxes.

-

C-Corporation Benefits: For businesses with high earnings and potential for reinvestment, a C-corporation might offer lower overall tax rates and additional deductions. C-corporations can also take advantage of a broader range of deductions and credits, making them an attractive option for larger businesses.

-

Partnerships: Structuring your business as a partnership can allow for flexible profit-sharing arrangements and pass-through taxation, where income is taxed at the individual partner level rather than at the corporate level. This can result in lower overall taxes, especially for businesses with varying levels of involvement from different partners.

Each business structure offers unique advantages and disadvantages, so it’s important to choose the one that aligns best with your business goals and tax strategy.

Taking Advantage of Tax Credits

Tax credits are an even more valuable income tax saving method than deductions because they directly reduce the amount of tax you owe. There are various tax credits available to business owners, which can lead to significant tax savings. Here are a few to consider:

-

Research and Development (R&D) Credit: This credit is available to businesses that invest in developing new products, processes, or software. The R&D credit can offset both income and payroll taxes, making it particularly valuable for innovative companies.

-

Work Opportunity Tax Credit (WOTC): This credit is available to employers who hire individuals from certain target groups, such as veterans or individuals who have faced significant barriers to employment. The WOTC can provide significant savings, particularly for businesses that are expanding their workforce.

-

Energy Efficiency Credits: Businesses that invest in energy-efficient equipment or renewable energy systems may qualify for various federal and state credits. These credits not only reduce your tax liability but also contribute to environmental sustainability, which can enhance your business’s reputation.

By taking advantage of this option to save tax, you can significantly reduce your overall tax liability, freeing up resources that can be reinvested in your business. It’s important to stay informed about the availability of these credits, as they can change from year to year.

How to Reduce Tax with Finance Management Tools?

Efficient financial management is crucial for minimizing tax liabilities and ensuring compliance with tax regulations. Using the right tools can help you track expenses, manage payroll, and accurately report your income and deductions.

Point-of-Sale (POS) Systems

A reliable POS system can be invaluable for managing business finances. Not only does it streamline transactions and inventory management, but it also helps maintain accurate records of sales and expenses. This accuracy is critical when calculating tax deductions and ensuring that all eligible expenses are accounted for.

For example, the ME-POS system offers comprehensive financial reporting features that can help you identify deductible expenses and track your income more effectively. By maintaining detailed records, you can reduce the risk of errors on your tax return and ensure compliance with tax regulations.

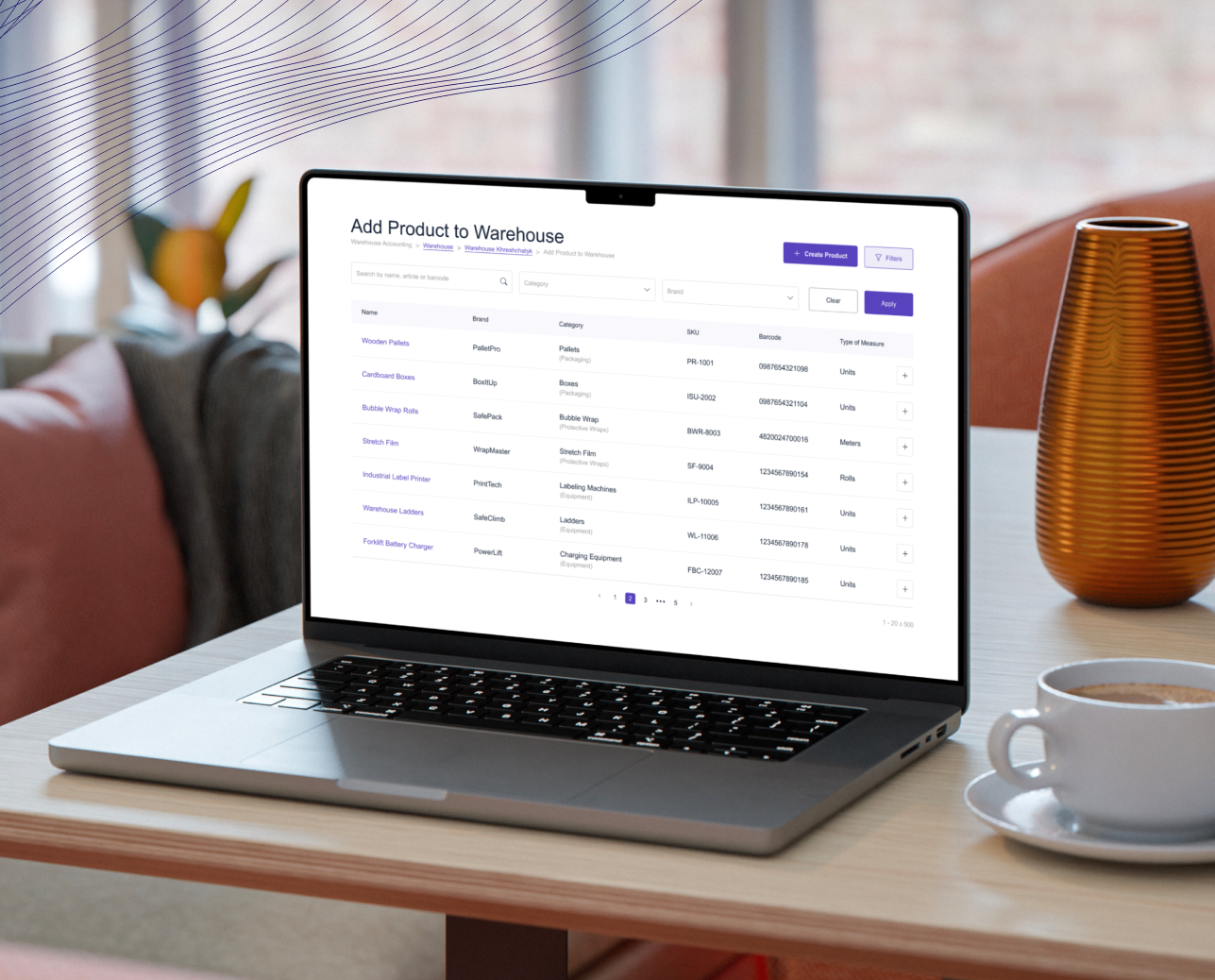

Accounting Software

In addition to a POS system, using financial accounting software can further simplify your financial management. This platform also integrates with POS systems, providing a seamless flow of information that can be crucial during tax season.

By combining these tools, you can ensure that your financial records are accurate and up to date, making tax season less stressful and more efficient.

Tax Planning Tips for Business Owners

Effective tax planning is an ongoing process that requires regular review and adjustment of your financial strategies. Staying proactive with your tax planning can help you avoid surprises at tax time and ensure that you're making the most of available tax-saving opportunities. Here are some practical tips to help you stay ahead:

-

Keep Accurate Records: Maintain detailed and accurate records of all your business transactions. This includes receipts, invoices, bank statements, and tax documents. Good record-keeping is essential for maximizing deductions and credits. Using digital tools to organize and store your records can make it easier to track your expenses and provide documentation if needed.

-

Plan for Estimated Taxes: If your business is profitable, you may be required to pay estimated taxes quarterly. Planning for these payments helps you avoid penalties and interest charges. Setting aside a portion of your income for estimated taxes can prevent cash flow issues and ensure that you’re prepared when payments are due.

-

Consult a Tax Professional: Tax laws are complex and constantly changing. Working with a tax advisor or accountant can help you navigate these complexities and ensure that you're taking full advantage of all available deductions and credits. A tax professional can also provide valuable insights into how changes in your business or the tax code may impact your tax liability.

-

Review Your Tax Strategy Annually: Your business's financial situation may change from year to year, and so should your tax strategy. Reviewing your strategy with a tax professional can help you adapt to new opportunities and challenges. Whether you’re expanding your business, investing in new assets, or hiring additional staff, adjusting your tax strategy can help you minimize your tax burden.

Implementing these ways to reduce taxes can help you stay on top of your tax obligations and make the most of the available tax-saving opportunities.

Conclusion

Reducing your income tax burden as a business owner requires a combination of understanding the basics, utilizing common deductions, and implementing advanced tax strategies. By choosing the right business structure, taking advantage of tax credits, and employing efficient financial management tools, you can significantly reduce your taxable income and improve your business's financial health.

Remember, tax planning is not a one-time event but an ongoing process that evolves with your business. Regularly consult with a tax professional to stay informed about new tax laws and strategies that could benefit your business. With careful planning and the right approach, you can minimize your tax liability and keep more of your hard-earned profits, allowing you to reinvest in your business and achieve your long-term goals.

View more

Related Articles

View more